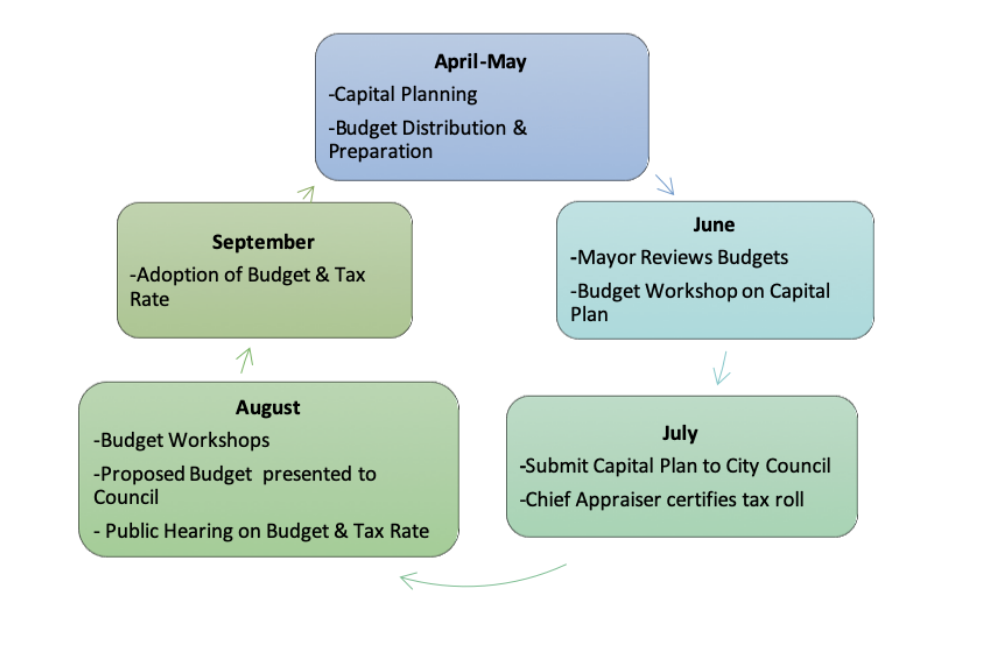

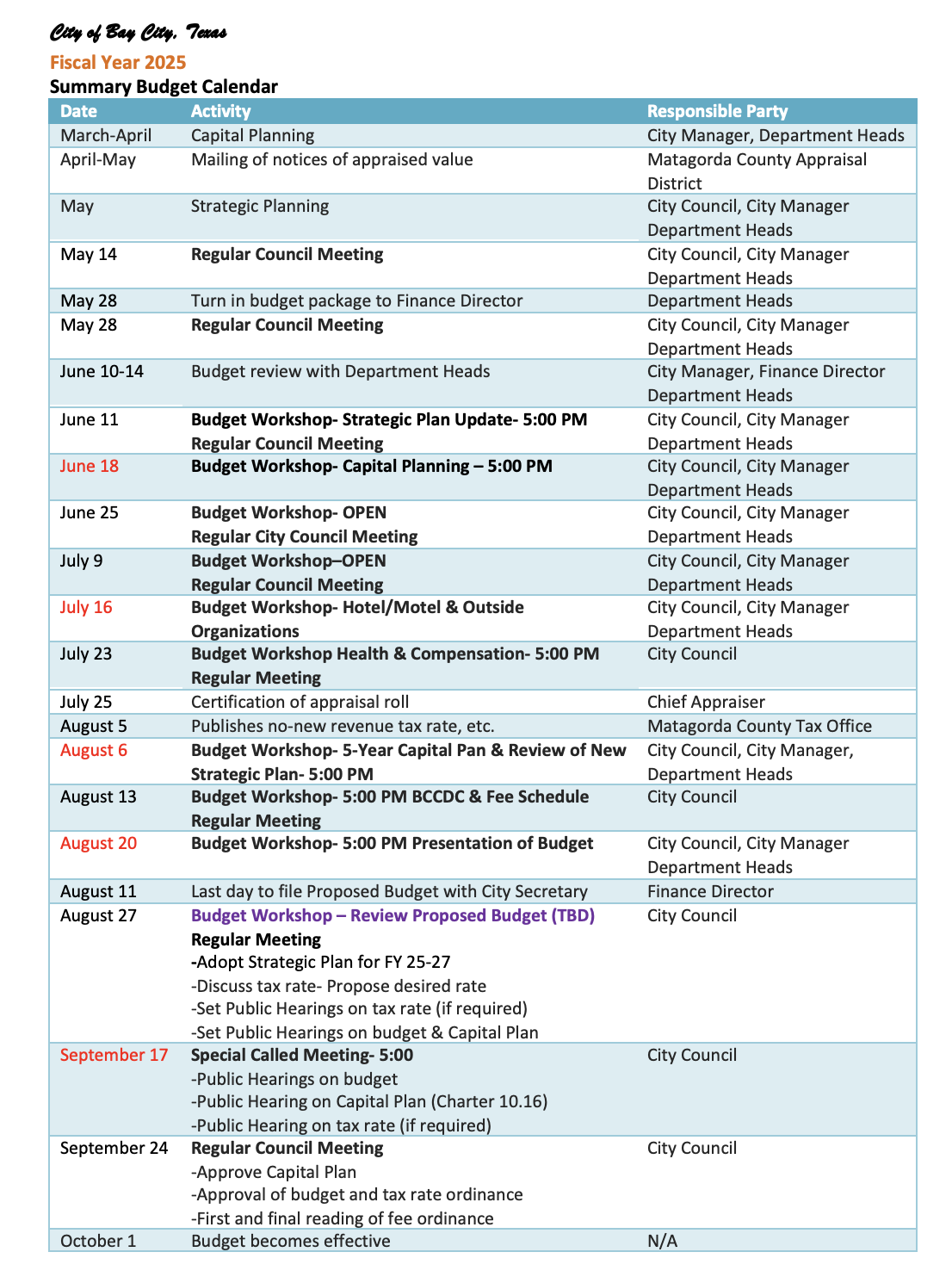

Budget Planning Calendar

Budgetary Process and Guidelines

The proposed budget must have a special cover page if the budget will raise more property taxes than in previous years.

Notice of Public Hearing for Budget shall be published not earlier than the 30 th or later than the 10 th day before the date of the hearing (Local Gov Code 102.0065 (c).

H.B. 3195 brings truth and taxation into the budget process. See new guidelines before publishing proposed budget.

Public Hearing for Budget must be scheduled after the 15 th day (Aug 26, 2025) after date the proposed budget is filed, 10 days after publication of the notice (September 6, 2023) but before the date the governing body makes its tax levy (Local Gov Code 102.006b).

Public Hearing is set for September 16, 2025. The City is only required to have one budget hearing. This is the time provided for Council to receive citizen input regarding the City’s Capital Plan, Proposed Budget, and the Bay City Community Development Corporations Budget.

The budget shall be adopted in final form before September 30 or 60 days after the certified totals are received. September 23, 2025 is the 23rd day of the last month of the fiscal year and no sooner than the 5 th day after the public hearing and not later than 10 days prior to the beginning of the fiscal year, so it meets these requirements. (City Charter Section 10.10).

A copy of the budget shall be sent to County Clerk’s office, the Bay City Public Library, and the City Secretary. (City Charter 10.11)

Tax Guidelines

Notice of Proposed Tax Rate shall be published not later than the 7 th day before the date of the public hearing (Tax Code 26.065) (publish one time for both dates); Notices must be published on Internet 7 days continuously before hearing & 7 days continuously before vote on tax rate.

Adoption of the tax rate must be a separate item on the agenda. State law requires most cities to adopt a budget before they adopt the tax rate. The City may adopt a budget and the tax rate at the same meeting as long as the budget is adopted first as a separate item.

Purpose of the Budget

The purpose of the annual operating budget of the City of Bay City is to:

- Act as a financial plan which describes the activities that will be undertaken during the current fiscal year.

- Define the resources available for the completion of those activities.

- Determine the level of taxation necessary to generate required revenue resources.

- Act as an operations guide by providing levels of expenditures allowed for the accomplishment of departmental and program objectives.

- Provide the public with information about the activities and objectives of the various city departments and programs and the financial condition of the City.

Budget Cycle Calendar